car lease tax deduction hmrc

Say your business use is 60 percent and you are making a monthly payment of 400 on it. With business leasing youll usually be required to pay tax that is calculated from the cars CO2 emissions the P11D value list price of the car and your personal income tax.

Electric Car Lease Through Limited Company Jf Financial

For example if you leased a car on or after 6 April.

. As explained by HMRC. Section-179 of the IRS tax code allows businesses to deduct the full cost of new or used equipment from their 2020 taxes. New York collects a 4 state sales tax rate on the purchase of all vehicles.

For more information about tax on company cars visit the HM Revenue Customs HMRC website. How do I deduct car lease payments. Publication 839 710 5 Introduction This publication explains the rules for computing State and local sales and use taxes on long-term motor vehicle leases.

You can claim back up to 50 of the tax on the monthly payments of your lease up to 100 of the tax on a maintenance package and depending on the vehicles CO2 emissions costs of. You can write off 240 for. In summary the restriction.

In certain cases the deduction for the cost of hiring a car which can be made in calculating the profits of a trade is restricted. 30000 x 34 percent the appropriate CO2 percentage x 40 percent 4080. The auto lease inclusion is netted against the amount of the lease payment.

Tot up your car lease payments plus any other expenses such as insurance and petrol which you. The key points to note from the new taxation regime is that. A 15 restriction applies to cars with CO2 emissions of.

Sales and use taxes are. One of the tax. The deduction for expenditure in computing the profits of a trade which is incurred on hiring certain cars is restricted.

As a limited company youll also pay extra National. You deduct the cost against profits. That makes the current-year tax bill on the car.

As corporation tax is 19 then your tax savings are calculated as 19. To assist in the growth of electric and PHEV options HMRC have changed their approach to company car tax as set out below. The IRS will let you deduct 60 of your car lease payment on your tax return.

You lease an electric car for 6000 over the 2022-23 financial year. Leasing a commercial vehicle through a limited company. For more information about tax on company cars visit the HM Revenue Customs HMRC website.

For vehicles that are being rented or leased see see taxation of leases and rentals. For vehicle tax deductions you have two options for. In some cases if you lease or hire a car you cannot claim all of the hire charges or rental payments.

You can write off 240 for every single lease payment the same formula applies to the other car. If The Car Emits Less Than 130GKm Deduct The. There are also a county or.

Applies to most cars with CO2 emissions.

Business Tax Relief On Leased Vehicles Car Lease 4 U

Financial Help If You Re Disabled Vehicles And Transport Gov Uk

.png)

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

Company Car Vs Company Car Allowance

Business Grants Incentives Ev Carshop

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

Is It Worth Buying An Electric Company Car Taxagility Small Business Accountants

Is It Better To Buy Or Lease A Car Taxact Blog

Salary Sacrifice Lease Cars Interim Hmrc Update Berthold Bauer Consultants

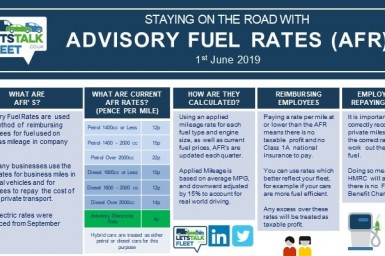

Lease Rental Restriction Letstalkfleet

Are Car Lease Payments Tax Deductible Lease Fetcher

Benefit In Kind Bik Company Car Tax Bands 2021 2025

The Tax Benefits Of Electric Vehicles Taxassist Accountants

Business Grants Incentives Ev Carshop

Tax And The Company Car Or Van Scrutton Bland

Is Leasing A Car Tax Deductible For Freelancers Freelance Heroes

Should I Lease A Car Through My Limited Company Or Personally